Local businesses: did you know increasing customer retention by just 5% can boost profits by 25-95%? This article reveals proven formulas to transform casual buyers into loyal advocates who spend 31% more and drive exponential growth through referrals.

Check out our other article about customer metrics here: https://amzoraltd.com/customer-journey-ai-personalization-marketing-techniques/

Key Takeaways

- Customer retention costs 5-25 times less than acquiring new customers, making it a critical profitability driver for local businesses

- Using the Customer Retention Rate formula helps identify loyalty patterns and business health

- A mere 5% increase in customer retention can boost profits by 25-95%

- Emotionally connected customers have 306% higher lifetime value than those who are merely satisfied

- Effective retention strategies transform casual buyers into loyal advocates who refer new business

Why Customer Retention is Your Most Profitable Growth Strategy

Think of your business as a bucket. You’re working hard to pour in new customers, but there’s a hole at the bottom letting them escape. That’s the reality for many local business owners who focus heavily on acquisition while neglecting retention. The numbers tell a compelling story: retaining existing customers costs 5-25 times less than acquiring new ones.

This isn’t just about saving money. When you prioritize customer retention, you’re investing in exponential growth. Content Marketing Agent, a customer experience consultancy, has found that businesses who master retention enjoy significantly higher profitability, as existing customers spend 31% more than new ones and are 50% more likely to try new products or services.

The financial impact is staggering. Research shows that increasing customer retention by just 5% can boost profits by 25-95%. Why such a dramatic effect? Because loyal customers don’t just spend more—they become advocates who bring in new business through referrals. These referred customers arrive with built-in trust, resulting in 37% higher retention rates and 18% greater loyalty than customers acquired through other channels.

Mastering the Customer Retention Rate Formula

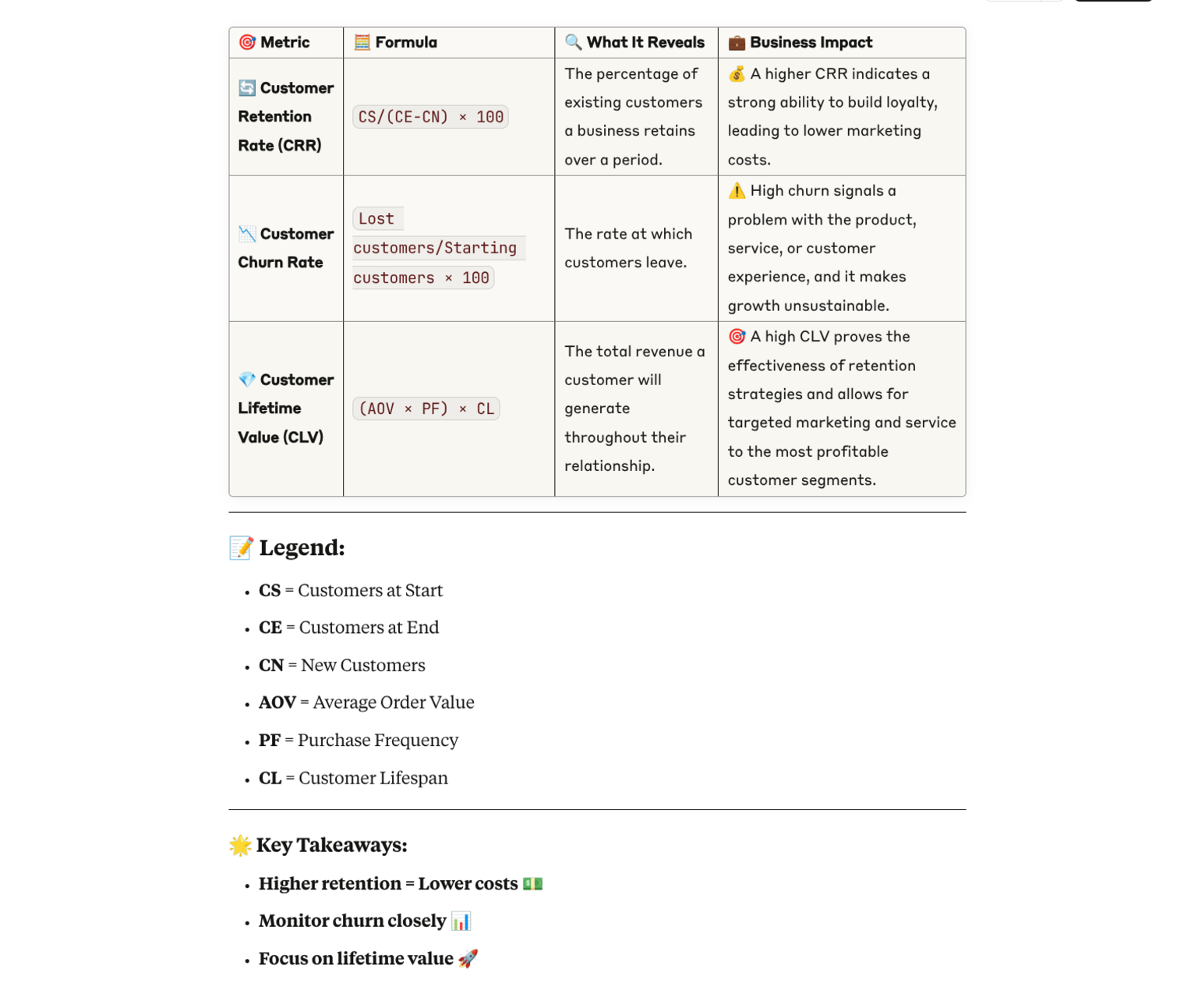

You can’t improve what you don’t measure. The Customer Retention Rate (CRR) formula provides the foundation for understanding how well your business keeps customers coming back.

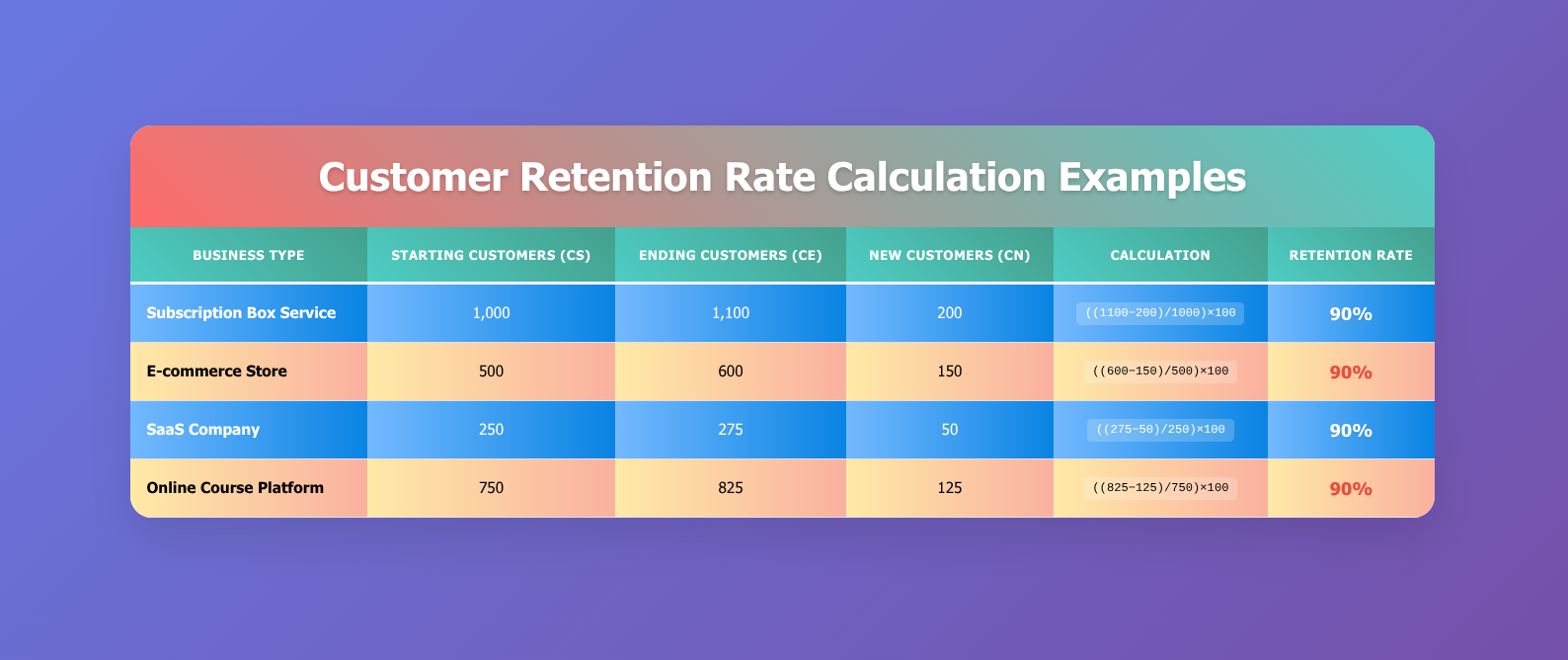

The formula is: ((E-N)/S)×100

Where:

- E = Number of customers at the end of a period

- N = Number of new customers acquired during that period

- S = Number of customers at the start of the period

This calculation gives you the percentage of original customers who remained with your business over a specific timeframe. It intentionally excludes new customers acquired during the period, focusing solely on your ability to retain existing ones.

For example, if you start January with 100 customers, gain 30 new ones, and end with 110, your retention rate would be: ((110-30)/100)×100 = 80%

This means you’ve kept 80% of your original customers while losing 20%. By tracking this metric consistently, you can identify patterns, test improvement strategies, and measure their effectiveness over time.

The inverse of retention rate is churn rate—the percentage of customers who leave. While retention tells you who stayed, churn highlights who left, making it equally valuable for identifying problems that need addressing.

How to Calculate Your Retention Rate in 3 Simple Steps

1. Gather your customer data

Before calculating anything, you need accurate customer data. This means tracking when customers first engage with your business and when they make subsequent purchases. For local businesses, this might involve:

- Point-of-sale systems that track customer purchases

- Loyalty programs that monitor member activity

- Appointment scheduling systems for service-based businesses

- Email lists that track engagement and purchases

The key is establishing a system that reliably identifies unique customers and their purchase patterns over time. Without this foundation, your calculations will be meaningless.

2. Apply the CRR formula correctly

Once you have your data, apply the formula properly by following these guidelines:

- Choose consistent timeframes (monthly, quarterly, or annually)

- Count each customer only once, regardless of purchase frequency

- Exclude new customers acquired during the period from your retention calculation

- Use the same methodology consistently to ensure comparable results

Make sure you’re tracking the right customer segments. Some businesses find it valuable to calculate separate retention rates for different customer groups, such as:

- High-value vs. occasional customers

- New vs. long-term customers

- Product-specific or service-specific retention

3. Interpret your results in context

A “good” retention rate varies significantly by industry. Retail businesses might consider 35% annual retention excellent, while subscription services often aim for 75-85% monthly retention. What matters most is tracking your trends over time and understanding what’s driving changes.

When analyzing your retention rate, consider these contextual factors:

- Industry benchmarks and seasonality

- Customer lifecycle stages

- Recent changes to products, pricing, or service

- Competitive landscape shifts

Note that even a 100% retention rate isn’t necessarily ideal—it might indicate you’re not attracting enough new customers, which limits growth potential.

The Hidden Costs of Customer Churn

1. Lost revenue opportunities

Every customer who leaves takes future revenue with them. This includes not just their next purchase, but all potential purchases over their lifetime. The financial impact compounds over time as you lose the opportunity to increase their spending, which naturally happens with loyal customers who spend 31% more per purchase.

2. Wasted acquisition costs

When customers churn quickly, you fail to recoup your customer acquisition costs (CAC). Imagine spending $50 to acquire a customer who makes a single $30 purchase and never returns—you’ve lost money on that relationship. For a local coffee shop, this might mean the promotional discount and marketing costs for a first-time visitor who never comes back. In contrast, retained customers continue generating revenue that justifies your initial acquisition investment.

3. Damaged brand reputation

Dissatisfied customers don’t just quietly disappear—they often share negative experiences with others. Research shows that unhappy customers tell an average of 9-15 people about their experience, while 13% tell more than 20 people. In tight-knit communities where local businesses operate, this word-of-mouth damage can spread quickly and significantly impact your ability to attract new customers.

4. Increased marketing expenses

High churn forces businesses into a costly acquisition treadmill, constantly spending to replace lost customers. This creates pressure to increase marketing budgets without necessarily improving profitability. For a small salon or restaurant with limited marketing resources, this can be particularly challenging. The math is simple: if you retain more customers, you can allocate more resources to growth initiatives rather than just maintaining your customer base.

5. Decreased employee morale

Constantly dealing with customer turnover takes a toll on your team. Service staff become demoralized when they can’t build relationships with repeat customers, and sales teams grow frustrated working in a “revolving door” environment. This can lead to employee turnover, creating additional costs and further hurting customer experience.

Creating Emotional Connections That Keep Customers Coming Back

Personalization beyond names: making customers feel understood

True personalization goes far beyond using a customer’s name in emails. It’s about demonstrating that you understand their specific needs and preferences. Research shows that emotionally connected customers have a staggering 306% higher lifetime value than merely satisfied ones.

Small businesses have a natural advantage here. Unlike large corporations, local business owners can actually remember customer preferences, family details, and past purchases. This personal touch creates a connection that large competitors struggle to match.

Practical ways to implement deeper personalization include:

- Keeping notes on customer preferences in your CRM system (a barista remembering a regular’s usual order)

- Recommending products based on previous purchases (a bookstore owner suggesting new releases similar to a customer’s past preferences)

- Acknowledging important customer milestones and events (a retail shop sending a small birthday discount)

- Creating custom offerings for your most valuable segments (a restaurant offering “chef’s table” experiences for frequent diners)

Proactive service: solving problems before they escalate

Customers are 2.4 times more likely to stay with a company that resolves problems quickly. But what’s even more powerful is addressing potential issues before customers even have to ask for help.

For local businesses, proactive service might include:

- A restaurant calling to confirm special dietary needs before a reservation

- A mechanic providing maintenance reminders based on previous service dates

- A retailer checking in after a major purchase to ensure satisfaction

- A salon following up after a new service to answer any questions

These touchpoints show customers you’re thinking about them, not just waiting for their next purchase. They transform the relationship from transactional to genuinely caring.

Community building: turning customers into brand advocates

When customers feel part of something larger than a business transaction, their loyalty deepens significantly. Creating a sense of community transforms customers into advocates who actively promote your business.

Effective community-building strategies for local businesses include:

- A bookstore hosting monthly reading groups or author signings

- A fitness studio creating challenges where members support each other

- A pet store organizing meetups for dog owners at local parks

- A café showcasing local artists or musicians on weekends

- A hardware store offering DIY workshops for home improvement projects

These efforts create an emotional investment that makes switching to a competitor feel like leaving a friend, not just changing vendors.

Industry Benchmarks: What’s a Good Retention Rate for Your Business?

Retail and e-commerce standards

The average annual customer retention rate for local retail businesses ranges from 20-40%. Top-performing retailers may reach 50% or higher. For local shops with e-commerce components, repeat purchase rates typically fall between 25-35% in the first year.

Retention metrics to track include:

- Purchase frequency (average time between orders)

- Repeat purchase rate (percentage of customers who buy more than once)

- Average order value trend over customer lifetime

Service business expectations

Local service-based businesses generally enjoy higher retention rates than retail, often ranging from 60-80% annually. This includes businesses like salons, spas, professional services, and maintenance companies.

Key retention metrics for service businesses include:

- Rebooking rate (percentage of clients who schedule their next appointment)

- Service upgrade frequency (how often clients add or upgrade services)

- Referral rate (new clients coming from existing client recommendations)

Hospitality and restaurant metrics

Local restaurants typically see return rates of 30-45% for first-time visitors. Top-performing establishments might reach 60%+ return rates. Factors that influence these rates include price point, location, and dining occasion (special occasion vs. everyday dining).

Hospitality businesses should monitor:

- Return visit timeframe (how quickly customers come back)

- Share of wallet (what percentage of a customer’s category spending you capture)

- Reservation cancellation rates (indicating potential satisfaction issues)

Leveraging Customer Lifetime Value to Drive Retention Strategy

Customer Lifetime Value (CLV) represents the total revenue a customer generates throughout their relationship with your business. For small businesses, this can be calculated simply:

CLV = (Average Purchase Value × Purchase Frequency per Year) × Average Customer Lifespan in Years

For example, if a regular at your local bakery spends $8 twice a week for an average of 3 years, their CLV would be: ($8 × 104 visits per year) × 3 years = $2,496

This metric reveals which customers and segments are most valuable over time, helping you prioritize your retention efforts. You might discover that young professionals who visit your coffee shop daily have a much higher CLV than weekend tourists, justifying more investment in weekday promotions.

Strategic applications of CLV include:

- Customer acquisition planning: A florist who knows wedding clients have a CLV of $2,000 (including future anniversaries and referrals) can justify spending more to acquire them than one-time buyers.

- Retention program ROI: A gym owner understanding the $1,500 lifetime value of members can justify investing $200 in better equipment or amenities to reduce churn.

- Segmentation for personalization: A boutique might create VIP experiences for their top 20% of customers who represent 60% of total revenue.

- Identifying at-risk valuable customers: A subscription meal service could proactively reach out to high-CLV customers who haven’t ordered in two weeks.

The Three Pillars of an Effective Retention System

1. Human-centric customer experience

At its core, retention is about human connection. Customers stay loyal to businesses that consistently make them feel valued and understood. This requires creating genuinely positive experiences at every touchpoint.

Key components include:

- Empathetic frontline staff: The barber who remembers not just your haircut preference but also asks about your recent vacation creates a connection that keeps you coming back.

- Seamless multi-channel experience: A local boutique ensuring that products seen on their Instagram can be easily purchased in-store or via their website provides consistency that builds trust.

- Expectation management: A restaurant that quotes a 45-minute wait but seats you in 30 minutes creates a positive impression through exceeded expectations.

- Problem resolution excellence: A hardware store that quickly replaces a defective tool without hassle often wins more loyalty than if the problem never occurred.

2. Post-purchase engagement

The period immediately after a purchase represents a golden opportunity to cement the relationship and increase the likelihood of future purchases.

Effective post-purchase strategies include:

- Thank you messages: A local jeweler sending a handwritten note after a significant purchase creates a memorable impression.

- Usage follow-ups: A pet store calling to check how a new food is working for a customer’s dog shows genuine care.

- Educational content: A wine shop emailing pairing suggestions for a recently purchased bottle adds value to the original purchase.

- Surprise additions: A bakery occasionally including a free cookie with a regular’s usual order creates delight and strengthens loyalty.

3. Strategic loyalty programs

Structured loyalty programs provide a framework for encouraging repeat business while gathering valuable customer data. Loyalty program members purchase 220% more per year than non-members, making these programs powerful retention tools.

For local businesses, effective programs include:

- Digital punch cards: A coffee shop offering a free drink after 10 purchases using a mobile app instead of easily-lost paper cards.

- Tiered benefits: A salon providing increasing perks (priority booking, complimentary add-ons) as clients reach silver, gold, and platinum status.

- Point systems: A pet store where customers earn points for purchases, reviews, and referrals, redeemable for discounts or exclusive products.

- Membership programs: A car wash offering unlimited monthly washes for a fixed fee, creating predictable revenue and increased visit frequency.

Common Calculation Mistakes That Skew Your Retention Data

Accurate measurement is essential for effective retention strategy. Avoid these common pitfalls that can lead to misleading results:

- Inconsistent time periods: Comparing a monthly retention rate to a quarterly one will give skewed results. A seasonal business like a garden center should compare this spring’s retention to last spring’s, not to winter metrics.

- Failing to exclude new customers: Remember that the CRR formula specifically measures how well you keep existing customers, not how many new ones you acquire.

- Double-counting customers: In the formula, each customer should be counted only once, regardless of how many purchases they make during the period.

- Ignoring segmentation: A restaurant’s overall retention rate might look decent while masking that they’re losing their high-spending dinner customers and only retaining lower-value lunch patrons.

- Misinterpreting seasonal fluctuations: An ice cream shop should compare year-over-year summer retention rather than comparing summer to winter numbers.

- Neglecting to account for natural customer lifecycles: A bridal shop naturally has longer intervals between purchases than a grocery store, affecting how retention should be measured.

- Focusing on the wrong metrics: Don’t get distracted by vanity metrics like social media followers. Focus on retention calculations that directly relate to revenue and profitability.

Your 90-Day Action Plan for Retention Success

Implementing a comprehensive retention strategy can be broken down into manageable steps:

Days 1-30: Measurement & Analysis

- Set up a simple spreadsheet to track basic customer purchase patterns

- Calculate your current CRR for your overall business and key segments

- Create a quick 3-question email survey to ask customers what they value most

- Identify your top 20% of customers by purchase frequency or spending

Days 31-60: Quick Wins & Strategy Development

- Implement personal thank-you notes or calls for purchases above a certain threshold

- Create a formal welcome process for first-time customers

- Train staff on recognizing and engaging with repeat customers

- Design a simple loyalty program appropriate for your business type

Days 61-90: Implementation & Refinement

- Launch your loyalty program with special incentives for early adoption

- Create a calendar of regular check-in points for different customer segments

- Develop a system for capturing and acting on customer feedback

- Schedule monthly reviews of retention metrics to track improvement

Remember that retention is a long-term strategy. The most successful businesses make it a core part of their culture rather than a one-time initiative.

By implementing these formulas and strategies, local business owners can transform casual customers into loyal advocates, dramatically increasing profitability and creating sustainable growth.Content Marketing Agent helps businesses develop and implement these retention strategies to maximize customer loyalty and long-term revenue.